georgia estate tax rate 2020

25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. The tax rate works out to.

Tax Rates Gordon County Government

However any estates worth more than that are taxed only on the amount that surpasses the 1206 million threshold.

. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Over 2600 but not over 9450. Outlook for the 2021 Georgia income tax rate is for the top tax rate to decrease further or change to a.

If taxable income is. You would pay 95000 10 in inheritance taxes. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

The approved 2020 General Fund millage rate of 9776 mills represents a decrease from 9899 mills in 2019 and is revenue neutral. The Georgia County Ad Valorem Tax Digest Millage Rates have the actual millage rates for each taxing jurisdiction. The rate remains 40 percent.

Georgias estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return Form 706. Georgia Estate Tax Rate 2020 More specifically georgia levies the following taxes. As of July 1 2014 Georgia does not have an estate tax either.

To make things simple if your estate is worth 1206 million or less you dont need to worry about the federal estate tax. 10 percent of taxable income. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes.

Maine for example levies no tax the first 58 million of an estate and taxes amounts above that at a rate of 8 percent to a maximum 12 percent. Before assuming that an estate is exempt it is critically important to analyze the estate because many assets such as life. Georgia law is similar to federal law.

Estate Tax - FAQ. 260 plus 24 percent of the excess over 2600. 2016 accrues at the rate of 12 percent annually.

Property tax and gas rates for the state are also close to the. Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate. In January 2019 the highest corporate tax rate and personal income tax rate will increase from 6 to 575.

Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Kentucky for example taxes inheritances.

Before the official 2021 georgia income tax rates are released provisional 2021 tax rates are based on georgias 2020 income tax brackets. Chatham County makes every effort to assure that the information presented on these web pages are up to date but to obtain the most accurate information you. Georgia estate tax rate 2020.

Local governments adopt their millage rates at various times during the year. The millage rates below are those in effect as of September 1. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Dor and county tag offices mv operations including in person online and kiosk services will be unavailable beginning thursday 12302021 7 pm through 132022. Federal Estate Tax Rates for 2022. The tax rate schedule for estates and trusts in 2020 is as follows.

The highest trust and estate tax rate is 37. The amount paid to Georgia is a direct credit against the federal estate tax. Due to the high limit many estates are exempt from estate taxes.

1536 Heritage Pass Milton GA 30004 in. Nevertheless you may have to pay the estate tax levied by the federal government. In a county where the millage rate is 25 mills the property tax on that house would be 1000.

Georgia Estate Tax Rate 2020. 1158 million for 2020 117 million for 2021 and 1206. Georgia income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020.

Tax amount varies by county. You would receive 950000. Over 9450 but not over 12950.

Georgia has no inheritance tax. In Gwinnett County these normally include county county bond the detention center bond schools school bond recreation and cities where applicable. Historical tax rates are available.

260 plus 24 percent of the excess over 2600. Does Georgia have an estate tax. The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year.

In Fulton County the states. The rate remains 40 percent. 083 of home value.

Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. Georgia is ranked number thirty three out of the fifty states in order of the average amount of property. By Busch Reed Jones Leeper PC.

2020 Georgia Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The estate would pay 50000 5 in estate taxes. July 07 2021.

EY Payroll Newsflash Volume 19 069 2018-5-4 Since counties and cities levy property taxes and assess property values according to their own rules the best way to assess property taxes is based on the amounts homeowners pay as a. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year.

It applies to income of 13050 or more for deaths that occurred in 2021. Even though there is no state estate tax in Georgia you may still owe money to the federal government. Use the tax table in the federal instructions to compute the credit.

Property is taxed according to millage rates assessed by different government entities. Then you take the 1158 million number. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Georgia estate tax rate 2020.

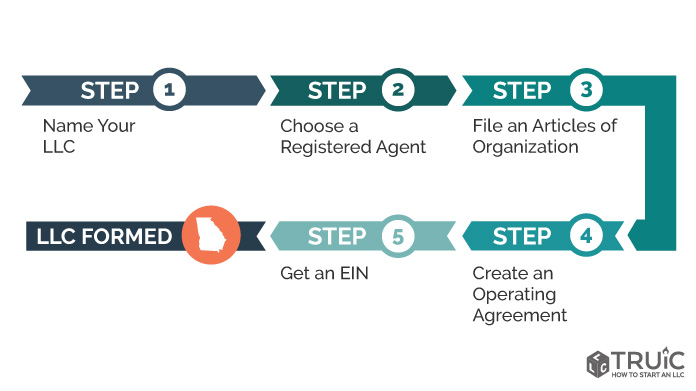

Llc Georgia How To Start An Llc In Georgia Truic

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Lower Property Tax Atlanta Ga Property Tax Firm Atlanta Property Tax Housing Market Tax Consulting

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

4 Questions To Ask Before Buying A Home Ryan Serhant Property Tax Buying A New Home Home Buying

Tax Rates Gordon County Government

3900 Tuxedo Rd Nw Atlanta Ga 30342 Mls 5985649 Zillow Colonial Farmhouse Real Estate House Styles

2021 Property Tax Bills Sent Out Cobb County Georgia

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Property Taxes Laurens County Ga

Georgia Property Tax Calculator Smartasset

Does Georgia Have Inheritance Tax

Llc Georgia How To Start An Llc In Georgia Truic

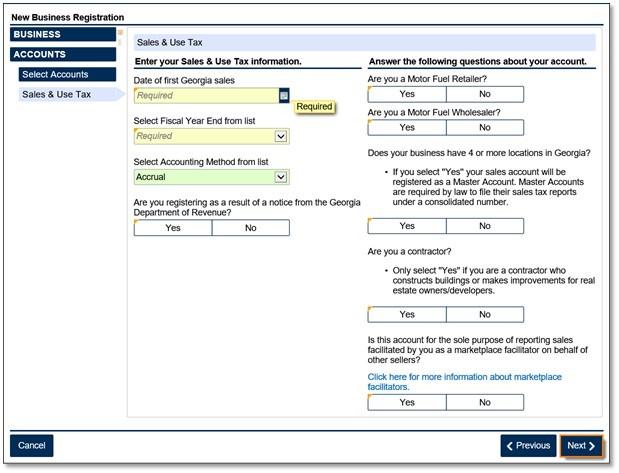

Georgia Sales Tax Small Business Guide Truic

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement