mobile county al sales tax form

Leasing Tax Form 3. Some cities and local governments in Mobile County collect additional local sales taxes which can be as high as 45.

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Room Rental Agreement

Alabama Tax Sales information registration support.

. For a copy of our Lodging Tax report form click here. General rate 350. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

Business License Renewals. Pursuant to Code of Alabama 1975 40-22-1 h. Access forms specific to Sales Use Tax.

The Mobile County Sales Tax is collected by the merchant on all qualifying sales made within Mobile County. Access detailed information on sales tax holidays in Alabama. The December 2020 total local sales tax rate was also 5500.

All City Services will be closed May 30 2022 for Memorial Day. Prepare and file your sales tax with ease with a solution built just for you. However pursuant to Section 40-23-7 Code of Alabama 1975 th in order to file quarterly bi-annually or annually for that calendar year.

Ad Have you expanded beyond marketplace selling. Please call the Sales Tax Department at 251-574-4800 for additional information. Mobile County property owners are required to pay property taxes annually to the Revenue Commissioner.

NO DUPLICATE OR REPLICATED FORMS ARE ACCEPTED. Drawer 161009 Mobile AL 36616 251. Please print out the forms complete and mail them to.

Revenue Forms and Applications. Maximum discount is 400. PJ on which Mobile tax has not been paid.

SalesSellers UseConsumers Use Tax Form. A mail fee of 250 will apply for customers receiving new metal plates. F Gross sales of liquid fuel gaseous fuel andor any other.

The Mobile County Alabama sales tax is 550 consisting of. Sales and Use Tax. If you have questions please contact our office at.

Mobile AL 36652-3065 Office. Only allowable if return is timely. Robertsdale AL 36567.

A discount is allowed if the tax is. 8 AM - 4 PM Kay A Hart-Tobacco Tax Collector. Column E Enter discount 5 of first 100 tax due or less and 2 for any tax over 100.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales. Heres how Mobile Countys maximum sales tax rate of 10 compares. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions.

Column D Enter tax due for EACH tax type due by multiplying tax rate by Column C net taxable. I further understand that any false statements claimed on this form may result in the imposition of the penalty indicated in Code of Alabama 1975 40-22-1 h. Access directory of city county and state tax rates for Sales Use Tax.

251 574 - 4800 Phone. Federal Tax ID Required Sole Proprietor need SS Corporation or Sole Proprietorship Name. See information regarding business licenses here.

The current total local sales tax rate in Mobile County AL is 5500. Mobile County Revenue Commission. For your research andor bidding needs.

Ad New State Sales Tax Registration. UPDATED-Tax Year 2021 Delinquent Taxes. 2020 rates included for use while preparing your income tax deduction.

Petition for Release of Penalty. Petition for Release of Penalty. Sales Tax Form 12.

Tuscaloosa County Sales Tax Return PO. The current total local sales tax rate in Mobile County AL is 5500. Revenue Commissioner Kim Hastie.

2 Choose Tax Type and Rate Type that correspond to the taxes being reported. Avalara can help your business. The latest sales tax rate for Mobile AL.

The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as 100 mail fee for decals. This rate includes any state county city and local sales taxes.

Our main office address is 3925 Michael Blvd Suite G Mobile AL 36609. PLEASE NOTE your assigned account number is to be used for all taxes reported such as sales use lease and lodging. Application for Developers Values.

Developers Price Value List. Comprehensive List Of Forms And Applications Available For The City Of Mobile AL. State of Alabama counties and incorporated cities and towns in Alabama f Sales of gasoline or lube oils g Other allowable deductions.

3 If you are an established Mobile County taxpayer skip One-Time Filing and enter your current Mobile County Sales and Use Tax account number in the Jurisdiction Account field. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information. Food Beverage Tax Form 7.

3925 Michael Blvd Suite G Mobile AL 36609. 10 Auto 05 Consumers Use Tax General Gross. Application for Current Use Valuation for Class 3 Property Return.

Business Personal Property andor Personal Aircraft Return. The Mobile County Sales Tax is 15. Board of Equalization-Appeals Form.

Delinquent Property Tax Announcement. The purpose of the tax lien auction is to secure payment of delinquent real property taxes in Mobile County. Joint Petition for Refund.

Sales Tax General Gross. Tax Year 2021. When is the sales tax due.

A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. Food Beverage Tax Form 7. 251 574 - 8103 Fax.

Skip to main content. For tax rate information please contact the Department at 256-532-3498 or at. Joint Petition for Refund.

Seller Use Tax Tax Form 13. Mobile AL 36652-3065 Office. Counties and incorporated cities and towns of Alabama h Sales to firms holding a city of Mobile Direct Pay Permit.

Vehicle Drive Out Info. Some cities and local. Or Updated for County Tax ID - Sales Use Tax Application.

2519283002 2519435061 2519379561 FAX 2519726836. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax. Leasing Tax Form 3.

Box 20738 Tuscaloosa AL 35402-0738 205 722-0540 Fax 205 722-0587. SALES USE TAX MONTHLYTAX RETURN CITYOF MOBILE POBOX 2745 MOBILEAL36652-2745 PHONE 251 208-7461. Sales Tax Form 12.

Mobile County collects a 15 local sales tax less than. I attest to the best of my knowledge and belief that the information contained in this document is true and accurate.

Template For Registration Form Luxury Team Registration Form Template Registration Form Templates Templates Printable Free

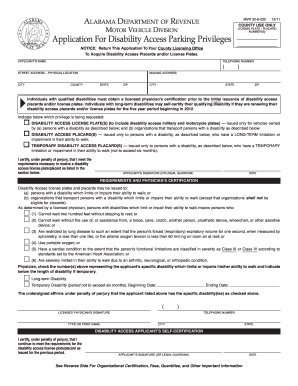

Alabama Handicap Placard Renewal Fill Out And Sign Printable Pdf Template Signnow

Forms Alabama Department Of Revenue

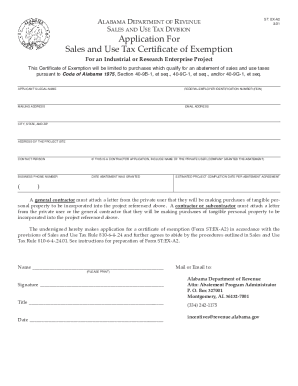

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Gas Bill Piedmont Gas Gas Bill Drivers License California Cps Energy

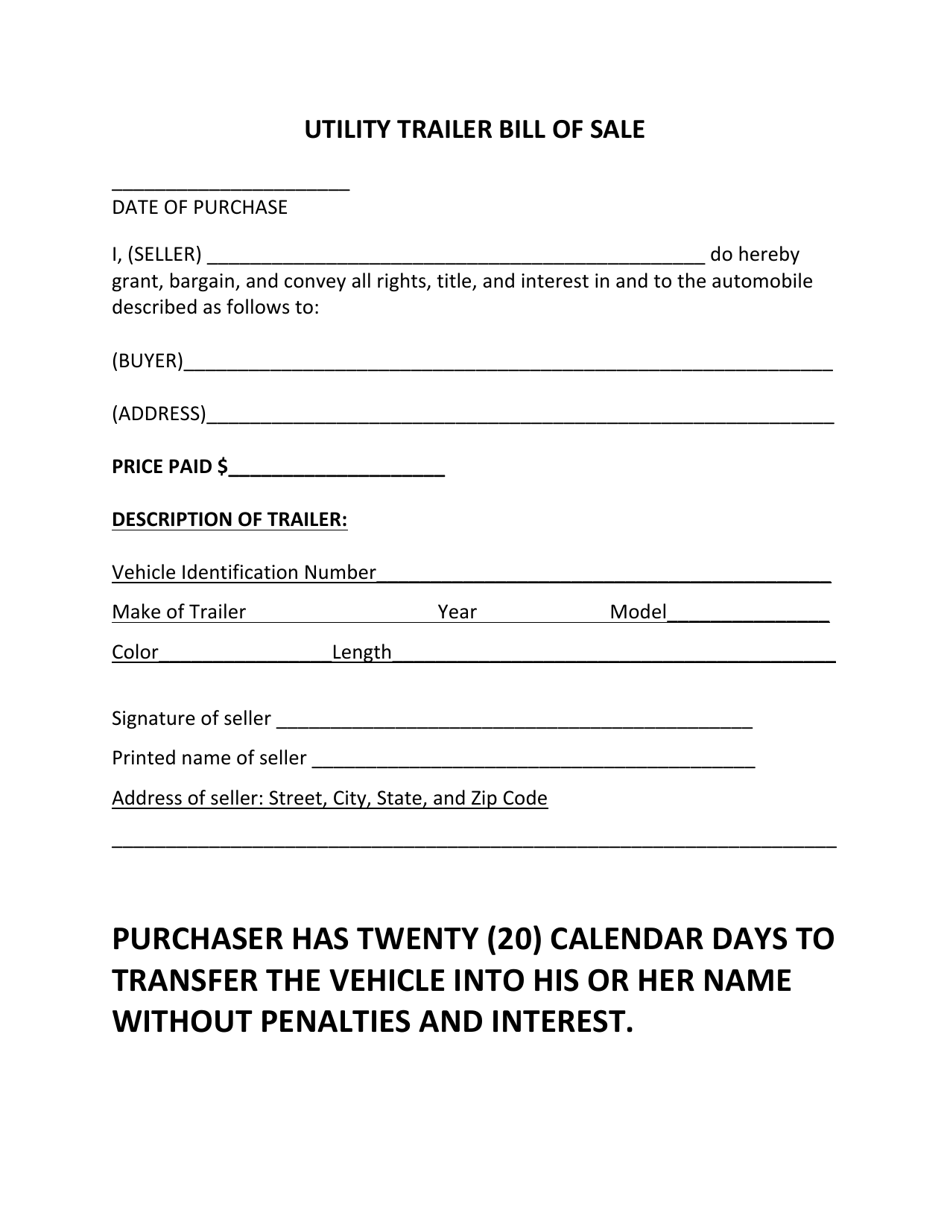

Coffee County Alabama Utility Trailer Bill Of Sale Form Download Printable Pdf Templateroller

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Free Alabama Mobile Home Bill Of Sale Template And Printable Form Usa Estimation Qs

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Alabama Quitclaim Deed Form Quitclaim Deed Will And Testament Free Resume

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Bill Of Sale Template Real Estate Contract

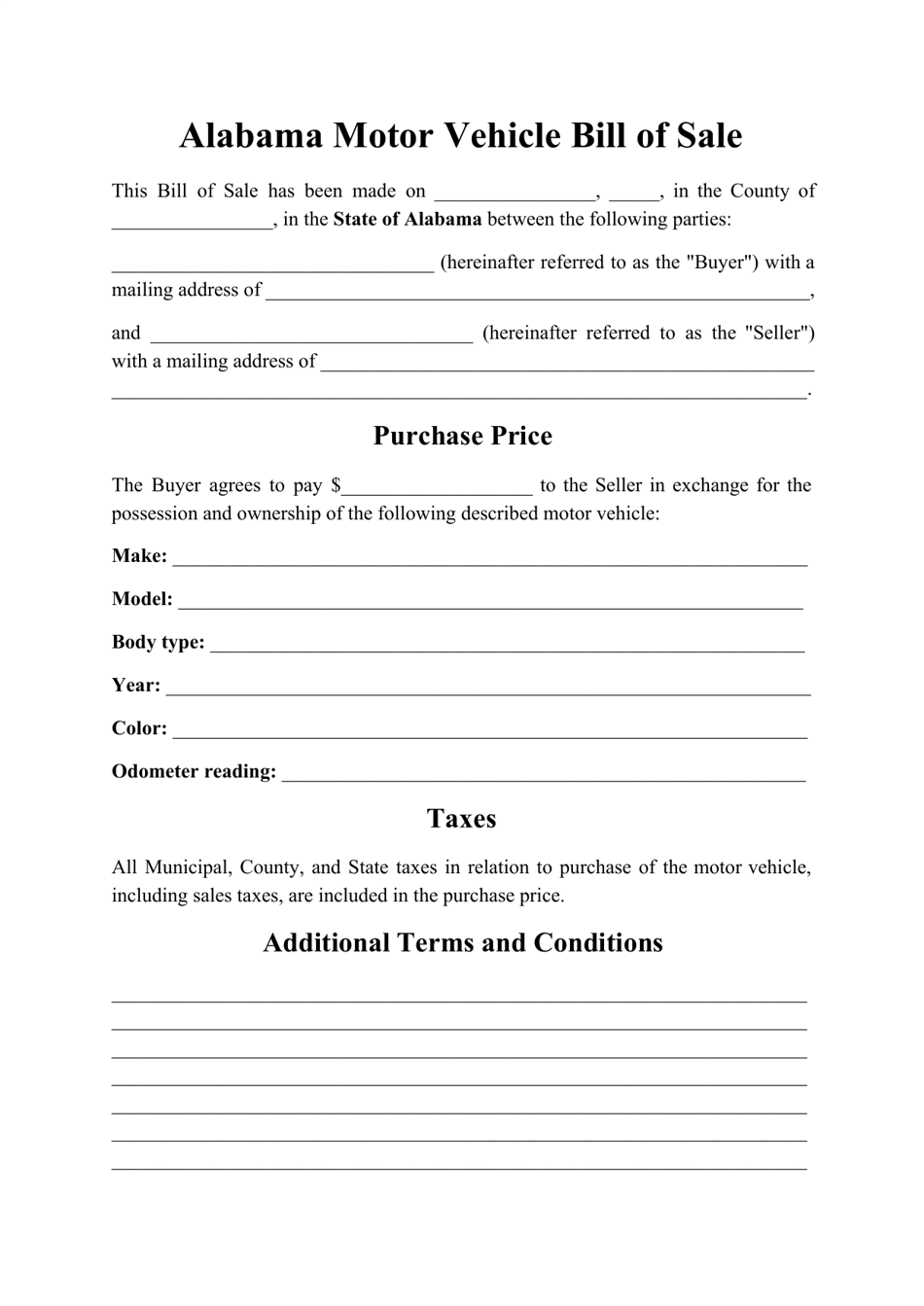

Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Alabama Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

Free Fillable Alabama Vehicle Bill Of Sale Form Pdf Templates